Please note

It is vital to ensure both seller and buyer are fully aware of their legal obligations under the agreed Terms of Sale. To avoid misunderstanding it is recommended that INCOTERMS 2000 are used and reference is made to such use on the contract of sale, plus all other relevant documents, i.e. pro-forma invoices, commercial invoices, documentary letters of credit etc. You should also ensure the correct INCOTERM is used so that in the event of any dispute, you have fulfilled your obligations under the chosen Term of Sale.

INCOTERMS from only part of the overseas contract of sale dealing solely with transportation. They are not a substitute for written trading conditions which should refer to other issues such as your right to retain ownership of the goods until paid for, payment terms, method of payment, the right to charge interest on overdue payments or liability for defective products etc.

INCOTERMS 2000

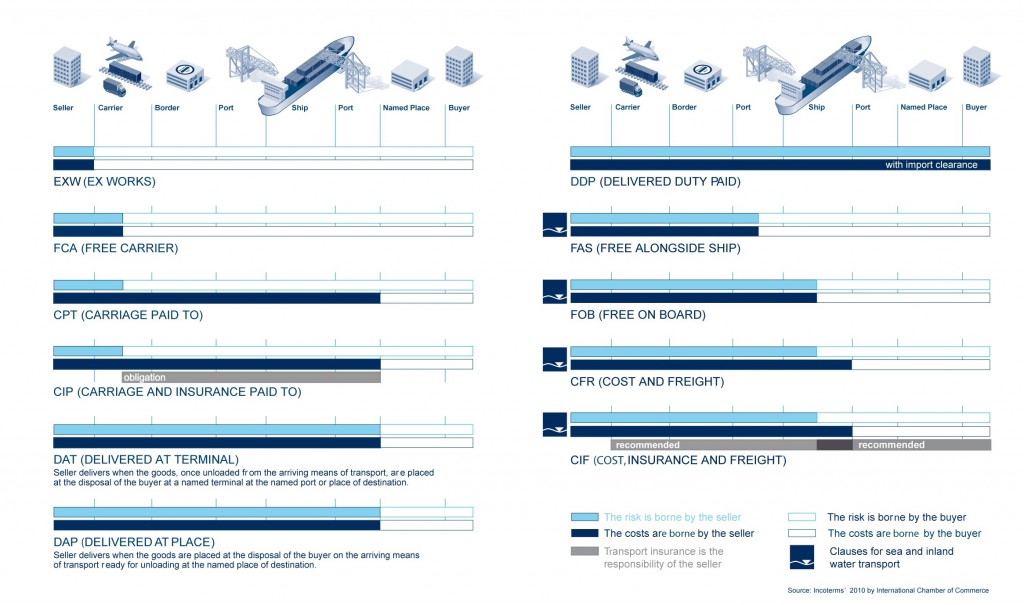

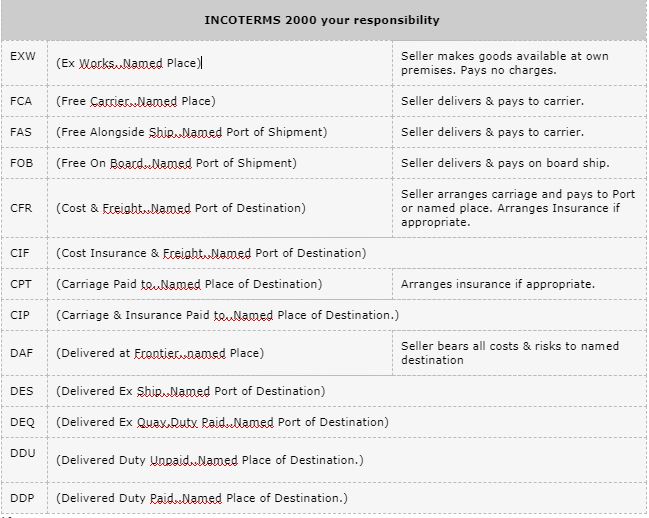

The purpose of Incoterms 2000 is to provide a set of international rules for the interpretation of the most commonly used trade terms in foreign trade. Thus, the uncertainties of different interpretations of such terms in different countries can be avoided or at least reduced to a considerable degree. The scope of Incoterms 2000 is limited to matters relating to the rights and obligations of the parties to the contract of sale with respect to the delivery of goods sold. Incoterms 2000 do NOT apply to the contract of carriage. A brief description of each Incoterm is outlined below:

EX WORKS (EXW)

The seller delivers when he places the goods at the disposal of the buyer at the seller’s premises or another named place (i.e. works, factory, warehouse, etc.) not cleared for export and not loaded on any collecting vehicle. This term represents the MINIMUM OBLIGATION for the seller, and the buyer has to bear all costs and risks involved in taking the goods from the seller’s premises. However, if the parties wish the seller to be responsible for the loading of the goods on departure and to bear the risks and all costs of such loading, this should be made clear by adding explicit wording to this effect in the contract of sale. This term should not be used when the buyer cannot carry out the export formalities directly or indirectly. In such circumstances, the FCA term should be used, provided the seller agrees that he will load at his cost and risk.

FREE CARRIER (FCA)

The seller delivers the goods, cleared for export, to the carrier nominated by the buyer at the named place. It should be noted that the chosen place of delivery has an impact on the obligations of loading and unloading the goods at that place. If delivery occurs at the seller’s premises, the seller is responsible for loading. If delivery occurs at any other place, the seller is not responsible for unloading. This term may be used for all modes of transport. “Carrier” means any person who, in a contract of carriage, undertakes to perform or to procure the performance of transport by rail, road, air, sea, inland waterway, or by a combination of such modes. If the buyer nominates a person other than a carrier to receive the goods, the seller is deemed to have fulfilled his obligation to deliver the goods when they are delivered to that person.

FREE ALONGSIDE SHIP (FAS)

The seller delivers when the goods are placed alongside the vessel at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that moment. The FAS term requires the seller to clear the goods for export. However, if the parties wish the buyer to clear the goods for export, this should be made clear by adding explicit wording to this effect in the contract of sale. This term can only be used for sea or inland waterway transport.

FREE ON BOARD (FOB)

The seller delivers when the goods pass the ship’s rail at the at the named port of shipment. This means that the buyer has to bear all costs and risks of loss of or damage to the goods from that point. The FOB term requires the seller to clear the goods for export. This term can only be used for sea or inland waterway transport. If the parties do not intend to deliver the goods across the ship’s rail, the FCA term should be used.

COST & FREIGHT (CFR)

The seller delivers when the goods pass the ship’s rail in the port of shipment. The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any other costs due to events occurring after the time of delivery, are transferred from the seller to the buyer. The CFR term requires the seller to clear the goods for export. This term can only be used for sea or inland waterway transport. If the parties do not intend to deliver the goods across the ship’s rail, the CPT term should be used.

COST, INSURANCE & FREIGHT (CIF)

The seller delivers when the goods pass the ship’s rail in the port of shipment. The seller must pay the costs and freight necessary to bring the goods to the named port of destination but the risk of loss of or damage to the goods, as well as any other costs due to events occurring after the time of delivery, are transferred from the seller to the buyer. However, in CIF the seller also has to procure marine insurance against the buyer’s risk of loss of or damage to the goods during carriage. Consequently, the seller contracts for insurance and pays the insurance premium. The buyer should note that under the CIF term the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have the protection of greater cover, he would either need to agree as much expressly with the seller or to make his own extra insurance arrangements. The CFR term requires the seller to clear the goods for export. This term can only be used for sea or inland waterway transport. If the parties do not intend to deliver the goods across the ship’s rail, the CIP term should be used.

CARRIAGE PAID TO (CPT)

The seller delivers the goods to the carrier nominated by him but the seller must in addition pay the cost of carriage necessary to bring the goods to the named destination. This means that the buyer bears all risks and any other costs occurring after the goods have been so delivered. “Carrier” means any person who, in a contract of carriage, undertakes to perform or to procure the performance of transport by rail, road, air, sea, inland waterway, or by a combination of such modes. If subsequent carriers are used for the carriage to the agreed destination, the risk passes when the goods have been delivered to the first carrier. The CPT term requires the seller to clear the goods for export. This term may be used for all modes of transport.

CARRIAGE & INSURANCE PAID TO (CIP)

The seller delivers the goods to the carrier nominated by him but the seller must in addition pay the cost of carriage necessary to bring the goods to the named destination. This means that the buyer bears all risks and any other costs occurring after the goods have been so delivered. However, in CIP the seller also has to procure insurance against the buyer’s risk of loss of or damage to the goods during the carriage. Consequently, the seller contracts for insurance and pays the insurance premium. The buyer should note that under the CIP term the seller is required to obtain insurance only on minimum cover. Should the buyer wish to have the protection of greater cover, he would either need to as much expressly with the seller or to make his own extra insurance arrangements. “Carrier” means any person who, in a contract of carriage, undertakes to perform or to procure the performance of transport by rail, road, air, sea, inland waterway, or by a combination of such modes. If subsequent carriers are used for the carriage to the agreed destination, the risk passes when the goods have been delivered to the first carrier. The CIP term requires the seller to clear the goods for export. This term may be used for all modes of transport.

DELIVERED AT FRONTIER (DAF)

The seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport not unloaded, cleared for export, but not cleared for import at the named point and place at the frontier, but before the customs border of the adjoining country. The term “frontier” may be used for any frontier including that of the country of export. Therefore, it is of vital importance that the frontier in question be defined precisely by always naming the point and place in the term. However, if the parties wish the seller to be responsible for the unloading of the goods from the arriving means of transport and to bear the risks and costs of unloading, this should be made clear by adding explicit wording to this effect in the contract of sale. This term may be used for all modes of transport when the goods are to be delivered at a land frontier. When a delivery is to take place in the port of destination, on board a vessel, or on the quay (wharf), the DES or DEQ terms should be used.

DELIVERED EX SHIP (DES)

The seller delivers when the goods are placed at the disposal of the buyer on board the ship not cleared for import at the named port of destination. The seller has to bear all the costs and risks involved in bringing the goods to the named port of destination before discharging. If the parties wish the seller to be responsible for the unloading of the goods from the arriving means of transport and to bear the risks and costs of discharging the goods, then the DEQ term should be used. This term can only be used when the goods are to be delivered by sea or inland waterway or multimodal transport on a vessel in the port of destination.

DELIVERED EX QUAY (DEQ)

The seller delivers when the goods are placed at the disposal of the buyer not cleared for import on the quay (wharf) at the named port of destination. The seller has to bear all the costs and risks involved in bringing the goods to the named port of destination and discharging the goods on the quay (wharf). The DEQ term requires the buyer to clear the goods for import and to pay for all formalities, duties, taxes, and any other charges upon import. If the parties wish to include in the seller’s obligations all or part of the costs payable upon import of the goods, this should be made clear by adding explicit wording to this effect in the contract of sale. This term can only be used when the goods are to be delivered by sea or inland waterway or multimodal transport on discharging from a vessel onto the quay (wharf) in the port of destination. However, if the parties wish to include in the seller’s obligations the risks and costs of the handling of the goods from the quay (wharf) to another place (warehouse, terminal, transport station, etc.) in or outside the port, the DDU or DDP terms should be used.

DELIVERED DUTY UNPAID (DDU)

The seller delivers the goods to the buyer, not cleared for import, and not unloaded from any arriving means of transport at the named place of destination. The seller has to bear all the costs and risks involved in bringing the goods thereto, other than, where applicable, any “duty” (which term includes the responsibility for and the risks of the carrying out of customs formalities, and the payment of formalities, customs duties, taxes, and other charges) for import in the country of destination. Such “duty” has to be borne by the buyer as well as any costs and risks caused by his failure to clear the goods for import in time. However, if the parties wish the seller to carry out customs formalities and bear the costs and risks resulting therefrom, as well as some of the costs payable upon import of the goods, this should be made clear by adding explicit wording to this effect in the contract of sale. This term may be used for all modes of transport, but when delivery is to take place in the port of destination on board the vessel or on the quay (wharf), the DES or DEQ terms should be used.

DELIVERED DUTY PAID (DDP)

The seller delivers the goods to the buyer, cleared for import, and not unloaded from any arriving means of transport at the named place of destination. The seller has to bear all the costs and risks involved in bringing the goods thereto including, where applicable, any “duty” (which term includes the responsibility for and the risks of the carrying out of customs formalities, and the payment of formalities, customs duties, taxes, and other charges) for import in the country of destination. While the EXW term represents the minimum obligation for the seller, DDP represents the maximum obligation for the seller. This term should not be used if the seller is unable directly or indirectly to obtain the import license. However, if the parties wish to exclude from the seller’s obligations some of the costs payable upon import of the goods (such as value-added tax: VAT), this should be made clear by adding explicit wording to this effect in the contract of sale. If the parties wish the buyer to bear all risks and costs of the import, the DDU term should be used. This term may be used for all modes of transport, but when delivery is to take place in the port of destination on board the vessel or on the quay (wharf), the DES or DEQ terms should be used.